Discover affordable weight loss surgery solutions with Dr. Harald Puhalla. Achieve lasting results and improve your health without breaking the bank. Get started today.

Sustainable weight loss can prolong and enhance your life, which is invaluable. Although there are costs to have weight loss surgery, it is an investment for a healthier you, and a solution to the ongoing battle with your weight. We provide high quality care at accessible prices, and accept patients with or without private health insurance.

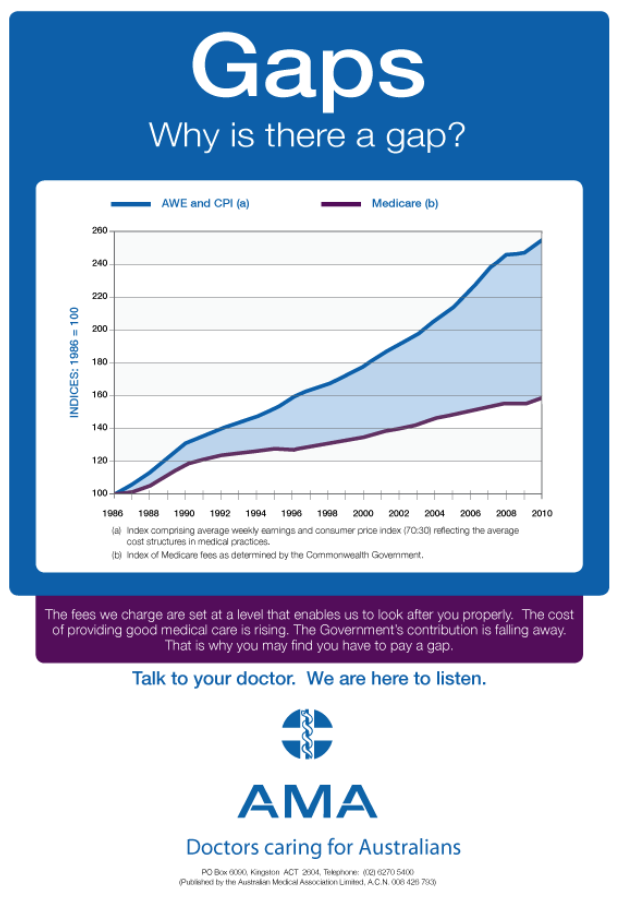

Why is there a gap?

While we endeavour to keep our prices as affordable as possible, there are still out of pocket costs. Our prices reflect the expertise and quality of Dr Puhalla’s services, and his team. Due to the high costs of long term follow-up, we do not participate in gap-cover or no-gap arrangements for weight loss surgery.

With this in mind, we understand that the cost of private health care without insurance can be expensive. Therefore, we can assist you with an application to the ATO for early release of your superannuation on compassionate grounds. For more information, visit the ATO’s website.

Initial consultation: $250.00 (Medicare rebate: $84.00)

Bariatric Follow up consultation (after surgery): $80.00 (Medicare Rebate: $42.30)

Follow up consultation: $90 (Medicare rebate: $42.30)

A non-refundable deposit of $100 is required to secure your initial bariatric consultation booking.

Payment methods include direct deposit or credit card (over the phone available).

You will need a GP referral addressed to Dr Puhalla to claim your Medicare rebates.

Follow up appointments after surgery have no charge within the first referral period for general surgery patients. After this, there may be a small out of pocket cost.

Follow up appointments after surgery for bariatric patients do have a $80.00 fee with a medicare rebate of $42.30.

Your surgery will have three fee components – surgeon, anaesthetist and hospital fees. These fees are separate accounts, and are dependent on the procedure type.

Upon booking your surgery, you will be given an Informed Financial Consent, which details the surgeon’s fees. This fee will include the surgeon’s fees for MBS item numbered procedures, surgical assistant fees and in-hospital visits. An exact quote cannot be provided before booking your surgery, as the exact procedure and item numbers need to be determined prior to issuing a quote. Medicare and health fund rebates are available on these fees, and are listed on the IFC.

Up-front fees are the same for insured and uninsured patients.

If you have private health insurance and are covered for the surgery item numbers, there are additional rebates available. Health fund rebates are not listed, as they vary from fund to fund. If you would like to find out what the health fund rebates are before you book your surgery, please contact your health fund.

Please note, for privately insured patients, we do not participate in gap-cover or no gap arrangements for weight loss surgery.

Placement of a minimiser ring costs $500. As there is no MBS item number for this, there is no Medicare rebate available.

Please note, these prices are approximate fees only, and are subject to change without notice. If you require additional procedures, such as a hiatus hernia repair (31468) or division of adhesions (30724), there will be additional fees and rebates.

As revision surgery is complex and can vary greatly in the way it is performed, costs cannot be provided until after your consultation with Dr Puhalla.

Anaesthetic fees are time-based, therefore fees provided before surgery are estimates only. The fee may vary according to the length and complexity of your surgery, your physical status and age. In the event where your surgery time goes above the estimated duration, there may be additional fees.

If you have private health insurance and are covered for weight loss surgery, fees vary depending on your health fund, the anaesthetist and their billing arrangements. Up-front costs may vary. Some anaesthetists charge a gap payment of around $500 and bill your health fund for the rest of the cost. Some charge the full up-front cost, varying between $1800 to $2500, and you claim rebates back after surgery. The maximum out of pocket is typically around $750 to $1000.

If you do not have private health insurance, fees typically vary between $1800 to $2500, with Medicare rebates available.

You may have other fees associated with your procedure, including pharmacy, pathology or radiology fees. These are separate costs that are payable to the provider. If you receive an account for any of these services, please contact the organisation with any queries. Please note, these costs cannot be quoted for.

Other costs to consider throughout the process may include dietitian fees and psychologist fees, as well as any other necessary specialist or doctor involvement, such as a pre-operative gastroscopy. For allied health fees, you may be eligible for Medicare rebates by obtaining a care plan from your GP.

The hospital fee will vary greatly if you have or do not have private health insurance.

If you have private health insurance and are covered for weight loss surgery, you will only have to pay your policy excess or co-payment to the hospital on the day of admission. This is typically around $250 to $500. If you are unsure of your coverage and/or excess or co-payment, please contact your health fund. Most health funds make excesses payable once during a calendar year, so if you have already been admitted to hospital in the same year, you may not have to pay anything more to the hospital on admission.

If you do not have private health insurance, you are liable for the entire hospital cost. These fees typically start at around $11,900 for theatre costs and one night accommodation, however they can be more expensive for additional or more complex procedures, or if you require a longer stay in hospital. Unfortunately, there are no Medicare rebates available for the hospital fee, however, you may be able to apply to the ATO for early access to your superannuation fund to pay for surgery costs.

Medicare does not consider the balloon a medical procedure, and therefore does not offer any rebates on the fees for the procedure. This means that private health funds also do not cover the costs or offer any rebates for the procedure, and cannot access your super to fund it.

Total costs for the balloon are approximately $7,500 to $10,000. This includes doctor’s fees, anaesthetist fees, and hospital fees for the insertion and removal of the balloon, as well as dietitian fees. As these fees are payable to the different service providers for the procedures, they are subject to change without notice.

Upon confirmation of your booking, exact quotes will be obtained and confirmed.

You may be able to apply to the Australian Taxation Office for early access of your superannuation to fund your surgery. We can assist you with the application, however there are a few things you should do before beginning the process.

We will provide you with detailed instructions on how to apply, as well as supply the necessary evidence to support your application, however it is your responsibility to submit the application and monitor its progress. The application and release of funds will require adequate time to be approved, so keep this in mind when planning your surgery. More information can be found on the ATO website under “Early access to your super”.

Please note, the super application process can only begin after your exact procedure is determined and scheduled, as the amount withdrawn is based on exact quotes. Whilst we understand that you may want to fast-track this process by requesting these quotes to be issued before booking your surgery, this cannot be done before your surgery details are finalised.

If you’d rather not use your superannuaion or don’t have enough funds in your super account to cover the costs of surgery, you may want to explore a flexiable payment plan through Total Lifestyle Credit (TLC). As the only patient funding platform approved by AHPRA, TLC offers competivite interest rates and a simple online application process.

Learn more about their payment plans here, or start your application here.

General surgery procedures also have three main fee components – surgeon, anaesthetist and hospital fees.

Depending on the procedure, surgeon fees for general surgical procedures are typically those recommended by the Australian Medical Association (AMA). Medicare and health fund rebates are available and will vary depending on the MBS item numbers used for your surgery.

Anaesthetic fees will vary depending on your procedure and its duration. More information will be available from your anaesthetist, which will be advised at the time of booking your surgery.

If you have private health insurance and are covered for the MBS item numbers of your surgery, hospital costs will be covered by your health fund, with only your excess or co-payment payable to the hospital on admission. It is recommended that you contact your health fund to confirm your coverage and excess/co-payment before your surgery.

If you do not have private health insurance, a quote will be obtained from the hospital prior to your surgery. Please note, the cost of having surgery in private hospitals without insurance can be expensive, however, we will do our best to minimise this cost as much as possible.

Other incidental costs may be associated with the surgery, including pharmacy, pathology and radiology fees. These fees cannot be quoted for and are typically issued after surgery.

If you would like more information about surgery costs, please do not hesitate to contact our office.